Tonight Wayne Swan brought down his fourth budget – Julia Gillard’s first as PM. But while Labor has a new Prime Minister, the Budget tells the same old story: more debt, larger deficits and higher taxes.

The Budget has no real plan to pay back Labor’s debt. As Terry McCrann outlined this morning the budget continues “splashing and spraying money round.”

And tonight, Alan Kohler slammed the Budget, saying “Any decent CFO would be embarrassed by this budget.”

The Budget fails the essential test: to ease the cost of living on Australians who face higher prices every day.

NEW TAXES…

At the heart of this budget is a massive hole – the absence of the details of the carbon tax means that the expenditure figures are wrong, as are the forecasts for inflation, economic growth and unemployment.

This is the first budget in eight years that has not cut personal taxes. Labor’s Budget outlines the higher tax burden on Australians including the flood tax and mining tax as it hits Australian families and the economy with new and higher taxes worth more than $6 billion.

Government revenue continues to grow to record levels.

…ALL TO FUND RECORD NEW SPENDING

The spending of this government continues to grow to unprecedented levels.

Spending blowouts continue in the disastrous home insulation and computers in schools programmes, to name just two.

Labor’s insatiable appetite for more and more government spending and an ever larger role for government in our lives continues unabated.

WHILE DEBT CONTINUES TO RISE TO RECORD LEVELS

And all the while, Australia’s debt hits record levels.

Only 6 months ago, the Government forecast a deficit for the current financial year of $42 billion. As if this is not bad enough, tonight we find out it is now going to be $50 billion.

In one year the Labor Government has run up more than half the debt it took the Coalition a decade to repay.

The coming year’s budget deficit has also blown out by just under $10 billion to $22.6 billion.

With Australia’s terms of trade at record levels, the bottom line should be in much better shape.

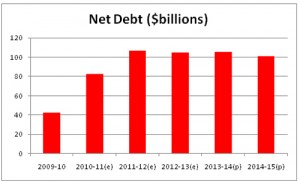

Net debt will climb to $107 billion in 2011-12 and will remain above $100 billion across the period covered by the budget forward estimates.

This year, the government is now borrowing $135 million each day, $1 billion a week, to fund its spending spree.

Remember, a promised surplus in future years does not mean the debt has been repaid.

By 2014-15, the Commonwealth will be spending $7.5 billion per year on interest payments – about $20 million every single day.

A FEW INTERESTING TIDBITS…

- Since coming to power, Labor has employed 24,000 extra public servants

- Following on from last year’s $10 million grant to the Trade Union Education Fund, the government has granted another $10 million to unions for training.

You will hear a lot more about this budget over the coming days and weeks. But no matter what Labor spins, remember that debt continues to rise, deficits are larger than predicted only six months ago and that higher taxes do not equal restraint or government savings.

This is a compromised Budget from a compromised Government. The only thing we can be sure of is more tax, more debt and more deficit. That will make Australia weaker, not stronger.