One of the potential consequences not immediately apparent from our recent string of natural disasters is that many affected small businesses may not reopen.

Experience from natural disasters in the United States suggests around 40% of small businesses may not reopen (see footnote). Small businesses are typically major employers in regional towns and their inability or failure to reopen has a long lasting impact on the economies of local communities and their capacity to recover.

Importantly, it is not only those businesses directly damaged by floods or cyclones that are at risk – businesses that rely on the damaged critical infrastructure to transport their goods, and on flood affected businesses and families as suppliers and customers.

This key fact is something of great concern to me and to the Coalition and that is why Tony Abbott has announced a substantial support package for small businesses affected by the Queensland floods and Cyclone Yasi.

On the weekend the Coalition called on the Gillard Government to extend concessional loans to businesses that experience a significant financial downturn as a consequence of recent flood and cyclone events. Previously, only businesses that experience actual physical damage were eligible for subsidised loans.

The Coalition has also called on Julia Gillard to provide a GST and PAYG (pay as you go) holiday to small businesses in flood-affected areas.

These measures will go some way to mitigating the damage suffered by small business and will help them recover as quickly as possible.

Labor’s flood tax will not help.

Within hours of its announcement, I found a loophole in Labor’s Flood Tax that may see flood victims, particularly the owners of small businesses, pay the flood tax – despite Julia Gillard’s commitment to the contrary. It got a run on radio news as well as in the Fairfax Press and on Perth radio.

There have also been reports of unnecessary bureaucracy that has seen multiple small businesses that operate under the same ABN may become ineligible for government grants and loans.

Labor’s long list of failures has had a substantial impact on the confidence of small business people. In the last seven days there have been four business confidence surveys that show small business confidence is in negative territory.

The December and January surveys from the National Australia Bank, the Commonwealth Bank and ACCI and from Telstra and COSBOA all show that small businesses are not confident about their future prospects.

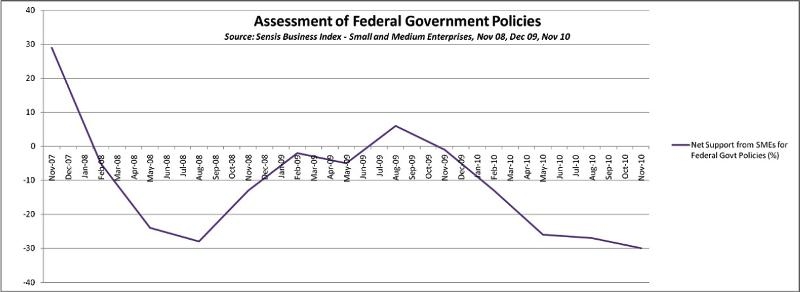

This does not come as a surprise. The most recent Sensis Business Index: Small and Medium Enterprises shows that support from small businesses for the federal government’s policies has collapsed by 59 percentage points since Labor took office in 2007. See for yourself:

Small businesses are the economy’s canary – their success or failure is indicative of the strength of the economy as a whole.

The Coalition has made sensible suggestions to improve the plight of disaster affected small businesses and to help them regain their confidence. Labor would be prudent to take them on board – it is in the national interest for small businesses to have the confidence to take on extra staff and grow their businesses.

However, with Wayne Swan talking down the economy, the crisis in business confidence under the Gillard Labor government is not likely to turnaround any time soon.