After months of hiding it from public scrutiny, earlier today Kevin Rudd and Wayne Swan released the Henry Tax Review, along with the Labor Government’s response. As expected, both the review and the Government’s response contained proposals for massive new taxes, dressed up in the language of reform.

Why is it that whenever we hear the word ‘reform’ from a Labor Government it always involves more taxing and spending?

A Great Big New Tax

The centrepiece of the Government’s plan is a great, big, new tax on resource companies – a so-called Resource ‘Super Profits’ Tax. In truth this is simply a $10 billion tax surcharge on our most significant export industry and some of our most successful companies.

This tax will hurt everyone because most Australians are exposed to the share price and dividends of the resource sector through their investment portfolio or superannuation fund.

The Labor Party is directly attacking your superannuation to fund its spending binge and deficits.

Those in the firing line, the Minerals Council of Australia, said that “Under the plan announced today, Australia will have the highest taxed mining industry in the world.”

The Labor Government is spinning this new tax on the basis that these companies make ‘super profits’. But Labor doesn’t tell you that the mining industry pays 27.8% of its income in tax, compared to the average Australian corporate rate of 24.55%. It already pays its fair share – as profits rise, so does tax paid.

This new tax also means that Labor will be determining what is a ‘normal return’ on investment. Once a resource company makes what the government determines is ‘super profits’, the new tax kicks in. Beware any other industry that starts to make high profits.

The reduction in the company tax rate to 28% only arrives in 2014 – and itself is a rejection of the Henry Review’s recommendations to cut it to 25%.

Small business hit again

Following historical form, the Labor Party has further attacked small business, increasing payroll costs by lifting the superannuation levy a further 3%.

This is the substance behind the spin: what Labor doesn’t tell you is that of the 2.4 million small businesses in Australia, only one third are companies – so only one third will benefit from the piddling 2% reduction in the corporate tax rate.

But every single small business with employees will have to pay an extra 3% on its payroll to fund the new superannuation levy. This represents nearly $10b each and every year coming out of the pockets of small business.

Squibbing reform

Let’s put this so-called reform in context. The government has only adopted two of the 138 recommendations of the Henry Review. This is not reform, it is simply a new tax in drag.

Every Australian should be worried about the other new taxes and tax increases the Government has either not commented on or ruled out. As with many of Labor’s promises, how can they be trusted? Remember Kevin Rudd’s solemn promise not to touch the Private Health Insurance Rebate? I wouldn’t bet against some of these ideas appearing in the Labor agenda in coming years.

* Congestion taxes

* Removing the FBT exemption for childcare provided on an employer’s premises

* Means testing the childcare rebate

The Coalition Record

Of course, comparison with the Coalition Government illustrates Labor’s failure in delivering serious and long-term tax reform. Economic management requires more than a press release, a powerpoint presentation and snappy one-liner.

The Coalition Government introduced the GST and abolished many inefficient state taxes. The Coalition Government halved the Capital Gains Tax to support investment and reduced the corporate tax rate from 36% to 30%. And the Coalition provided substantial cuts in income taxes.

Funding Labor’s deficits

Contrary to Labor’s claim of locking in higher growth, these proposals simply lock in higher taxes.

As it has with tobacco companies and private health insurance, the Labor Government demonises those it seeks to tax.

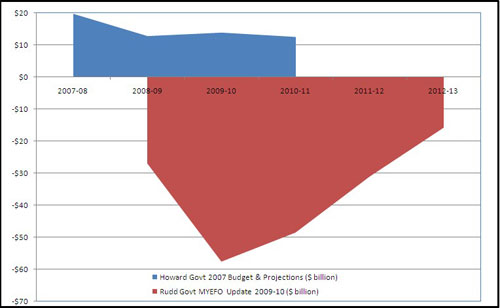

We cannot forget that Labor inherited a massive budget surplus – sufficient to sustain Australia through the global recession. But Labor has spent Australia into record levels of deficit and debt. This is a tax grab to plug that hole.

While they forecast a return to surplus in future years – we have yet to see any real action to restrain government spending to deliver this.

Early reaction

This is a government desperate for an agenda.

As Denis Shanahan in the Australian wrote earlier this afternoon “There is a much longer list of abandoned policies than there are genuine reforms in the first term of the Rudd government.”

Alan Kohler said “The so-called tax reform package announced today by Treasurer Wayne Swan is just a new resources rent tax, plus a few destinations for money that will be raised from it.”

The Australian Chamber of Commerce and Industry said the government failed to deliver “bold reforms”.

Also this afternoon, the Institute of Chartered Accountants said the government had the opportunity to address the structural impediments in the tax system that create complexity and a compliance burden for business and that “Today the government failed to take that opportunity.”

Channel 7’s David Koch said “… it looks like we’re going to get the usual

drip feed and spin from a Government more interested in political spin than

substance.”

The Labor tax package is not reform, it is a tax grab dressed up with slogans and backdrops for the cameras and front pages. Repeating the word ‘reform’ ad nauseum does not make it so.

Labor’s proposals will not make Australia stronger, are unfair to those industries and companies that have been successful and will not make our tax system simpler.

The Coalition will continue to fight for real reform that underpins future growth – and just as we did in Government, we will not shy away from the difficult decisions necessary to ensure a strong economy and balanced budget.