Just a few weeks ago, Kevin Rudd was channelling the ghosts of Rex Connor and Pauline Hanson in his drive to impose a great big new tax on mining. He said:

”BHP is 40 per cent foreign owned, Rio Tinto is more than 70 per cent foreign owned. That means these massively increased profits … built on Australian resources, are mostly in fact, going overseas,’

Yet it turns out that Labor’s new tax will probably increase foreign ownership of Australia’s mines. Not that this is a problem because our resources industry has thrived with foreign investment.

It simply shows that Kevin Rudd will say anything to get himself on the nightly news, no matter how damaging, incorrect or inconsistent. This week, Andrew Robb pointed out that Swan and Rudd were relying on one flawed US paper that even the authors say should not be used.

“Whoever chose to use that table as if it delivered some precise measurement on that was not the right thing to do,” Mr Markle, a co-author of the paper, told The Australian Online. “Our paper has nothing to do with what it is being used for in this debate. Our question was does (tax) domicile still matter.”

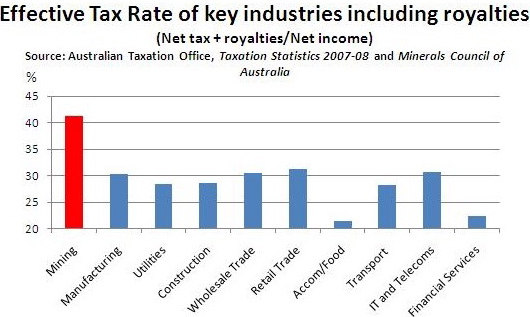

This is another reason why the Rudd Labor Government is so dangerous. They manufacture evidence to support their arguments. The 17% tax rate they claim applies to mining companies is a furphy. Just look at this graph:

The damage Labor’s great big new tax on mining is doing is fast becoming apparent. Indeed damage has already been done to Australia’s international reputation.

Fortescue has put on hold its’ US$9 billion Solomon Hub and US$6 billion Western Hub projects and Rio Tinto has shelved the $11 billion expansion of its iron ore operations. This great big new tax proposal has already threatened $26bn worth of investment from just two companies.

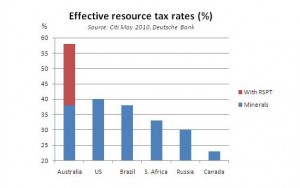

If this tax is imposed, Australian miners will face some of the highest taxes in the world.

This is what Kevin Rudd and Wayne Swan don’t want you to consider:

And this great big new tax is already damaging the value of Australian companies.

My interrogation of the Government’s superannuation funds manager during Senate Estimates hearings this week confirmed that the mining super tax can be expected to reduce the value of resource stocks by 10%.

In other areas, the Future Fund admitted that the government-created uncertainty surrounding the National Broadband Network was forcing the price of Telstra down.

And we found out that the Department of Finance had only one week to develop a $14 billion stimulus package. This led to a $1.7 billion blowout in the package and the unprecedented failure in getting value for money.

The Rudd Government needs to go before it does more damage to the Australian economy and the prospects of future generations of Australians.